RTG vs STS Cranes: Ultimate Selection Guide 2025

Introduction to Container Handling Giants

In modern port operations, two colossal machines dominate container handling: Rubber-Tyred Gantry (RTG) cranes and Ship-to-Shore (STS) cranes. These engineering marvels form the backbone of global trade, efficiently moving millions of containers annually between vessels and land transportation networks. As we approach 2025, port operators face increasingly complex decisions when selecting the right equipment for their facilities. This comprehensive guide will dissect every critical aspect of RTG and STS cranes, providing port planners, terminal operators, and logistics managers with the knowledge needed to make informed investment decisions.

The global container handling equipment market is projected to reach $18.7 billion by 2025, growing at a CAGR of 4.3%, according to recent industry reports. This growth is driven by expanding international trade, vessel upsizing trends, and the pressing need for operational efficiency. Understanding the fundamental differences between RTG and STS cranes is essential for optimizing port infrastructure investments. We’ll explore their structural designs, operational capabilities, cost structures, and emerging technological innovations that are reshaping port operations worldwide.

Structural and Operational Differences

Physical Configuration and Mobility

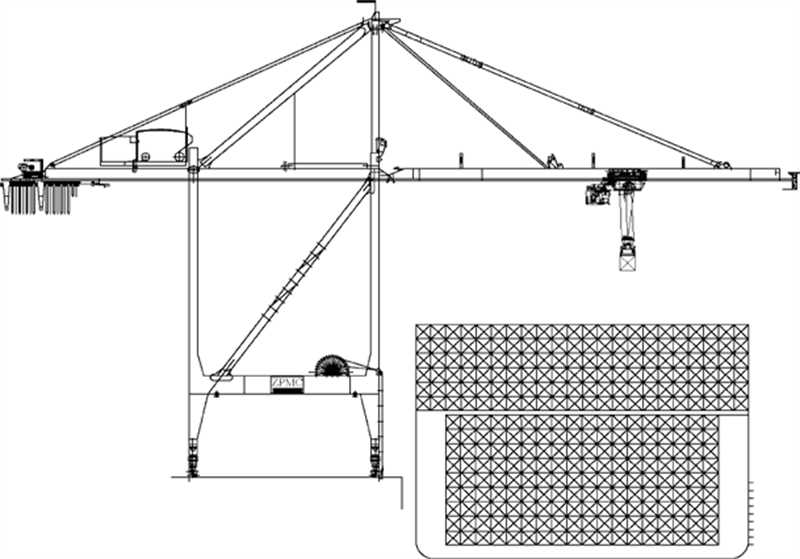

The most striking difference between RTG and STS cranes lies in their physical configuration and mobility. STS cranes are the towering giants of port infrastructure, permanently installed on rails along the quayside. These massive structures typically stand 80-120 meters tall (when booms are raised) with outreach capabilities spanning 20-24 rows of containers on today’s ultra-large container vessels. Their fixed position allows direct vessel loading/unloading but limits operational flexibility.

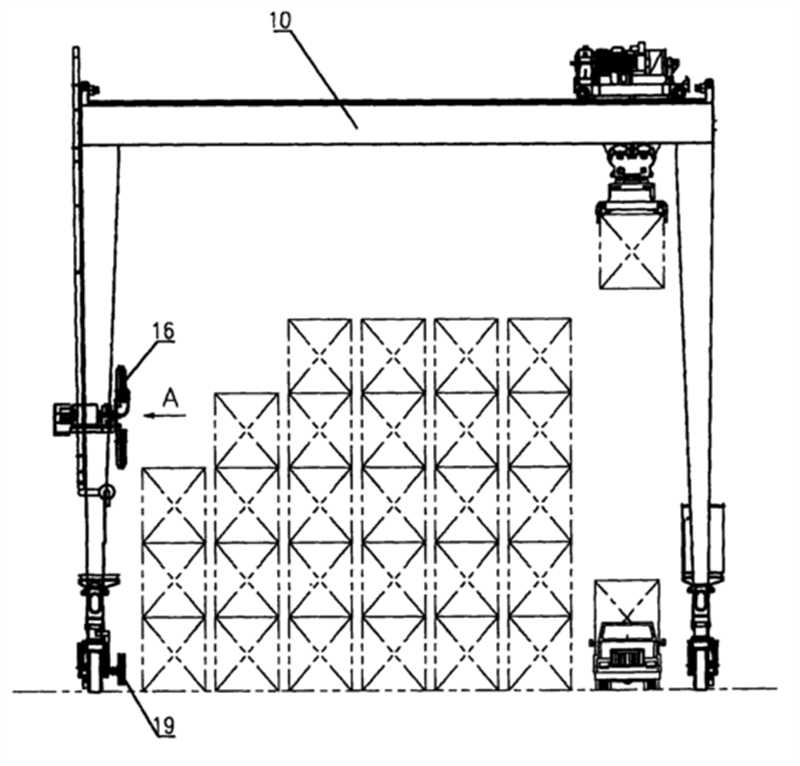

RTG cranes, in contrast, are the mobile workhorses of container yards. Mounted on rubber tires, these cranes can move freely between container stacks, typically handling 1-over-5 or 1-over-6 container arrangements. Modern RTGs feature 8-wheel or 16-wheel configurations, with the latter providing enhanced stability for taller stacking operations. Their mobility comes at the cost of lifting capacity – while STS cranes routinely handle 50-100 ton loads, RTGs typically max out at 40-50 tons.

Operational Range and Capabilities

Operational ranges differ significantly between these crane types. STS cranes specialize in horizontal movement across vessel beams, with:

- Outreach capabilities spanning 40-70 meters to reach across mega-vessels

- Backreach of 15-25 meters for landside operations

- Lifting heights of 30-50 meters above quay level

RTG cranes excel in vertical stacking operations with:

- Span widths of 18-35 meters (covering 6+ container lanes)

- Stacking heights up to 8 containers high (1-over-7 configuration)

- Travel speeds of 50-100 meters/minute when repositioning

The operational sweet spot for STS cranes is direct vessel interface, achieving 25-40 moves per hour under optimal conditions. RTGs typically manage 15-25 moves per hour in yard operations but can service multiple vessels through yard organization.

Power Systems and Environmental Impact

Power systems represent another key differentiator. Modern STS cranes are predominantly electric, drawing power from port grid systems or alternative energy sources:

- Typical consumption: 150-400 kWh per operating hour

- Regenerative braking systems can recover 15-25% of energy

- New hydrogen-powered prototypes emerging in Europe/Asia

RTG cranes historically relied on diesel generators but are transitioning to:

- Hybrid systems (diesel-electric)

- Full electric (via conductor bars or battery systems)

- Lithium-ion battery packs with opportunity charging

- Average fuel consumption: 15-30 liters/hour for diesel models

Environmental considerations increasingly favor electric RTG and STS models, with ports like Los Angeles and Rotterdam implementing strict emissions standards that phase out diesel equipment by 2030.

Cost Analysis and Investment Considerations

Capital Expenditure Comparison

The financial investment required for these crane types differs dramatically. A single STS crane represents a major capital project, with 2025 pricing estimated at:

- Standard STS Crane: $8-12 million

- Automated STS Crane: $12-18 million

- Mega-Sized STS (for 24,000+ TEU vessels): $15-25 million

RTG cranes offer significantly lower entry costs:

- Diesel RTG: $1.2-1.8 million

- Electric RTG (cable reel): $1.5-2.2 million

- Battery-Electric RTG: $1.8-2.5 million

- Automated RTG (aRTG): $2.5-3.5 million

Operational Cost Breakdown

Lifetime operational costs reveal different financial profiles:

STS Cranes (25-year lifespan)

- Energy: $6-10 million

- Maintenance: $3-5 million

- Labor: $4-6 million (semi-automated)

- Total: $13-21 million

RTG Cranes (15-year lifespan)

- Energy/Fuel: $1.5-3 million

- Maintenance: $1-2 million

- Tires (replace every 2-3 years): $600,000

- Labor: $2-4 million

- Total: $5-9 million

ROI and Productivity Metrics

Productivity differences significantly impact return on investment:

| Metric | STS Crane | RTG Crane |

|---|---|---|

| Moves/hour | 30-45 | 18-28 |

| Containers/lifetime | 1.8-2.4 million | 600,000-900,000 |

| Cost per move | $2.50-$3.80 | $3.20-$5.00 |

| Payback period | 8-12 years | 5-8 years |

These metrics demonstrate that while STS cranes require greater upfront investment, their superior productivity provides better long-term economics for high-volume ports.

Application Scenarios and Selection Criteria

Ideal Use Cases for STS Cranes

STS cranes prove indispensable in these scenarios:

- Deep-water terminals (draft > 14 meters)

- Required for servicing Ultra Large Container Vessels (ULCVs)

- Minimum 22-row outreach for modern vessels

- High-volume ports (>1 million TEU annually)

- Singapore’s PSA terminals operate 80+ STS cranes

- Automation-ready greenfield projects

- Shanghai Yangshan Phase IV uses 26 automated STS cranes

- Specialized cargo operations

- Heavy lift capabilities for project cargo

- Twin-lift configurations for efficiency

When RTG Cranes Make More Sense

RTG solutions shine in these conditions:

- Multi-purpose terminals

- Flexibility to serve ships, trucks, and rail operations

- Hamburg’s Altenwerder terminal uses 70+ RTGs

- Space-constrained ports

- Rubber tires allow operation in tight spaces

- Can be repositioned as operational needs change

- Budget-conscious operations

- Lower capital costs suit regional ports

- Phased acquisition possible

- Intermodal hubs

- Direct transfer between ship/truck/rail

- No need for intermediate shuttle carriers

Hybrid Solutions and Future Trends

Emerging operational models combine both technologies:

- STS+RTG coordinated systems

- STS handles vessel interface

- RTGs manage yard operations

- Automated guided vehicles (AGVs) or straddle carriers provide transfer

- Automated stacking cranes (ASC) alternatives

- Rail-mounted yard cranes gaining popularity

- Higher density than RTGs but less flexible

- Mobile harbor cranes

- For multi-purpose terminals with occasional container needs

Technological Innovations Shaping the Future

Automation and Smart Features

Both crane types are undergoing rapid technological transformation:

STS Automation Advances

- Machine vision systems:

- AI-powered container recognition

- Reduces misplacement to <0.01%

- Auto-spreaders:

- Automatic twistlock handling

- Cuts 3-5 seconds per move

- Predictive motion control:

- Anticipates vessel movement

- Compensates for swell/wave action

RTG Smart Technologies

- Auto-steering systems:

- GPS/RFID guided

- ±2cm positioning accuracy

- Battery management:

- Fast-charging systems

- 10-minute charges for 4-hour operation

- Tire pressure monitoring:

- Real-time sensors

- Redcessive tire wear by 30%

Energy and Sustainability Innovations

Environmental pressures are driving green technology adoption:

STS Eco-Innovations

- Shore power connection standards

- Hydrogen fuel cell prototypes (e.g., ZPMC’s 2024 test unit)

- Solar panel-integrated crane houses

RTG Green Solutions

- Battery-swapping stations

- 5-minute full swaps in Chinese ports

- Supercapacitor energy recovery

- Captures 90% of lowering energy

- Biodiesel/HVO fuel compatibility

- Cuts CO2 by 80% versus diesel

Digital Integration and IoT

Both crane types benefit from Industry 4.0 integration:

- Digital twins:

- Virtual simulation models

- Test operational scenarios without downtime

- Remote operation centers

- Operators can control cranes from miles away

- Predictive maintenance

- Vibration sensors anticipate bearing failures

- Reduces unplanned downtime by 40%

Decision Framework and Conclusion

Selection Flowchart for Port Planners

- Annual Volume Threshold

- >800,000 TEU: STS required

- <300,000 TEU: RTG likely sufficient

- Middle range: Hybrid solution

- Vessel Size Considerations

- Post-Panamax+: STS mandatory

- Panamax/smaller: RTG possible

- Land Availability

- Compact footprint: RTG advantage

- Linear quay space: STS appropriate

- Automation Strategy

- Full terminal automation: STS+ASC

- Semi-automation: RTG with auto-steering

- Budget Parameters

- Capital available: STS for growth

- Limited funds: RTG with expansion path

Recommendations for 2025 Purchases

Based on current trends and technological trajectories:

For Greenfield Projects

- Invest in automated STS with 24-row outreach

- Pair with electric ASCs rather than RTGs

- Design for future hydrogen infrastructure

For Brownfield Upgrades

- Retrofit existing RTGs with automation kits

- Consider battery conversions for diesel RTGs

- Add 1-2 STS cranes if vessel sizes increase

For Regional Ports

- New generation electric RTGs most flexible

- Lease mobile harbor cranes for peak periods

- Implement gradual automation starting with TOS integration

Final Thoughts

The RTG vs STS decision remains one of the most consequential choices in port planning. As we move through 2025, the convergence of automation, alternative energy, and digitalization is transforming both technologies. While STS cranes continue to dominate high-volume hub ports, innovative RTG solutions are becoming increasingly sophisticated for regional and specialized applications. The most successful ports will be those that strategically match equipment choices to their specific operational profiles, growth trajectories, and sustainability goals. By understanding the comprehensive comparison presented in this guide, port operators can make investment decisions that will serve their needs well into the 2030s.